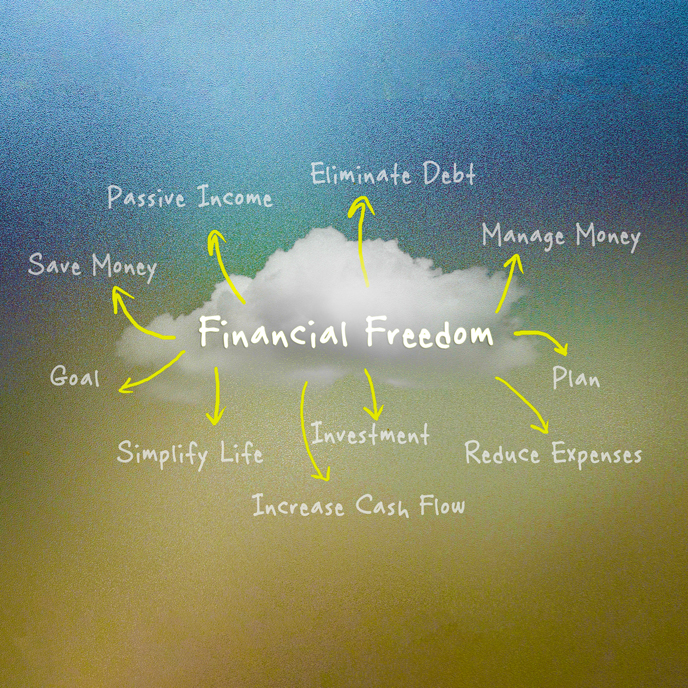

Financial freedom looks a little different for each person, but at the end of the day, it’s as much about knowing what’s important to you as it is about making money. Financial freedom is having sufficient income to cover your cost of living, while having enough time and money to pursue the lifestyle you desire. Freedom to choose when, where and how to live your life.

For many people, financial freedom means growing a nest egg that will enable them to retire or pursue their dream job without trading time for money. Financial burdens force us to make desperate choices that often hurt our long term financial goals.

How can you pursue financial freedom in your life?

Know your ideal lifestyle.

Without longterm goals and dreams, it’s hard to gain momentum growing your financial assets. Identifying what kind of lifestyle you want is the first step to real financial freedom. Are you interested in traveling? Dream of starting a nonprofit? How do you like to spend your free time? Do you want to start a new hobby or perfect some old ones?

Whether you’ve always wanted to buy a yacht, learn to dance, or just hire a housecleaner, putting a real number to your ideal lifestyle gives you a financial target. The difference between a classic car collection and candle making hobby is hundreds of thousands of dollars, and will determine how much money you need to really be free. Know your number.

Create a budget.

Once you’ve identified your ideal lifestyle and figured out your number, it’s time to make a monthly budget. There’s a lot of different tools out there you can use to track your budget and different theories around how much should be spent on needs, wants, and savings – find the one that works for you.

A good rule of thumb is to live below your means, keeping at least 20% of your net income to save and invest, including a six month emergency fund. Most wealthy people have developed the habit of living below their means, by learning to be happy with less. Living below your means doesn’t mean to deny yourself new and fun things in life, it simply means learning to distinguish between the things you need and the things you want, and making short term sacrifices for long term gains.

Keep good debt.

There are a lot of financial gurus out there who will tell you that all debt is bad. But that’s simply not true. Good debt is defined as money owed for things that help build wealth or increase income and bad debt would be credit cards and consumer debt that does little to improve your monthly cashflow.

That being said, your credit score is directly linked to the length of time you’ve had an open line of credit, as well as your spending habits and how well you handle your monthly payments. A good credit score is used to determine your interest rate when you get a bank loan or refinance your house, so keeping open lines of credit and making regular payments is a good habit.

Credit cards and other high-interest debt are toxic for building wealth, and you should only keep them if you are in the habit of paying off the balance every month. However, student loans, mortgages and other low interest debt is less toxic, given that you still make timely payments, because it keeps you cashflow free, allowing you to invest in other money-making assets and opportunities.

Supplement your income.

Regardless of whether or not you’re already investing 20% of your income, the fastest way to grow your investments is to supplement your income. It can be hard to gain traction when money is tight and you’ve already cut unnecessary expenses. But even better than pinching pennies, is earning extra income.

There are many opportunities to supplement your income with the goal of furthering your investments. Offering private lessons for something you’re good at, turning your hobby into cash, or renting out an extra room are just a few ideas. Just make sure your side hustle is a means to an already determined end and not another endless demand on your time and energy.

Don’t wait to get started.

Whether you already have a large savings or just getting ready to start, now is the time. If you’re still learning about investments and researching your options, now is the time to start. Don’t wait for another paycheck, another month, another bill to take action. The sooner you get started, the more your money can grow for you.

And finally, remember that the best ROI you’ll ever get is the investment you make in yourself. Education and experience are two things no one can take from you. Sign up for a class, earn a certification, learn a new skill or read a book. Invest in your mind, invest in your health, invest in your relationships.

What does financial freedom mean for you?